X-Mas Review Software & IT

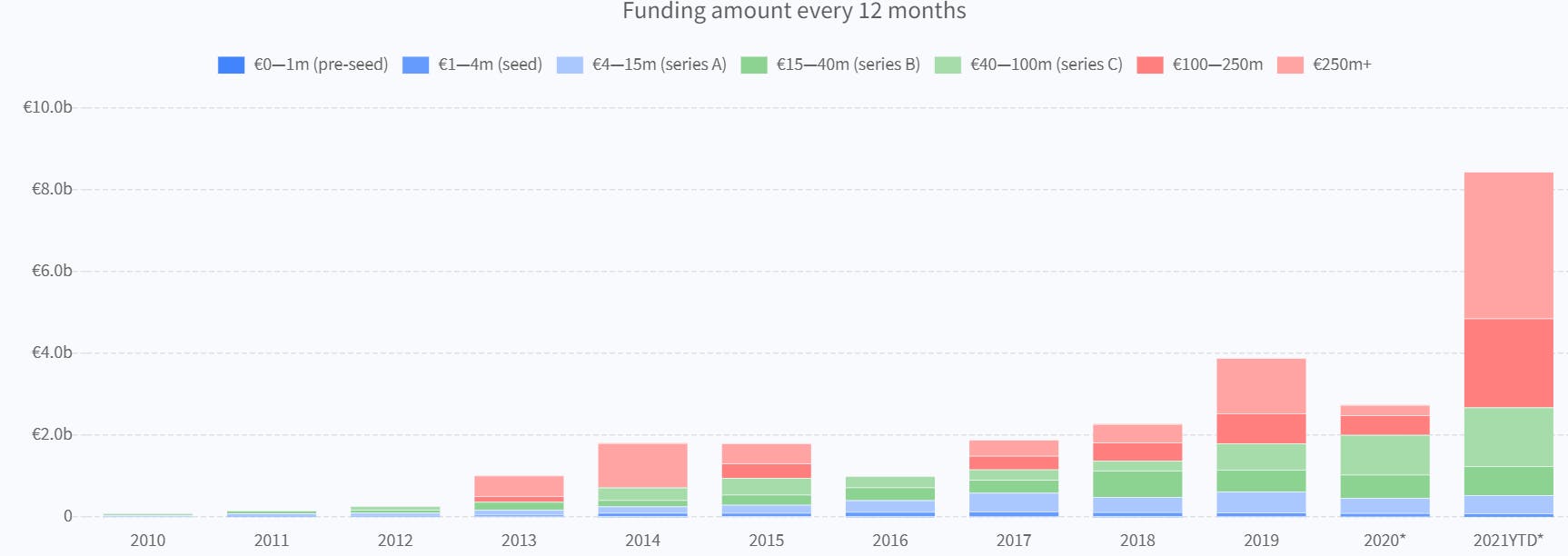

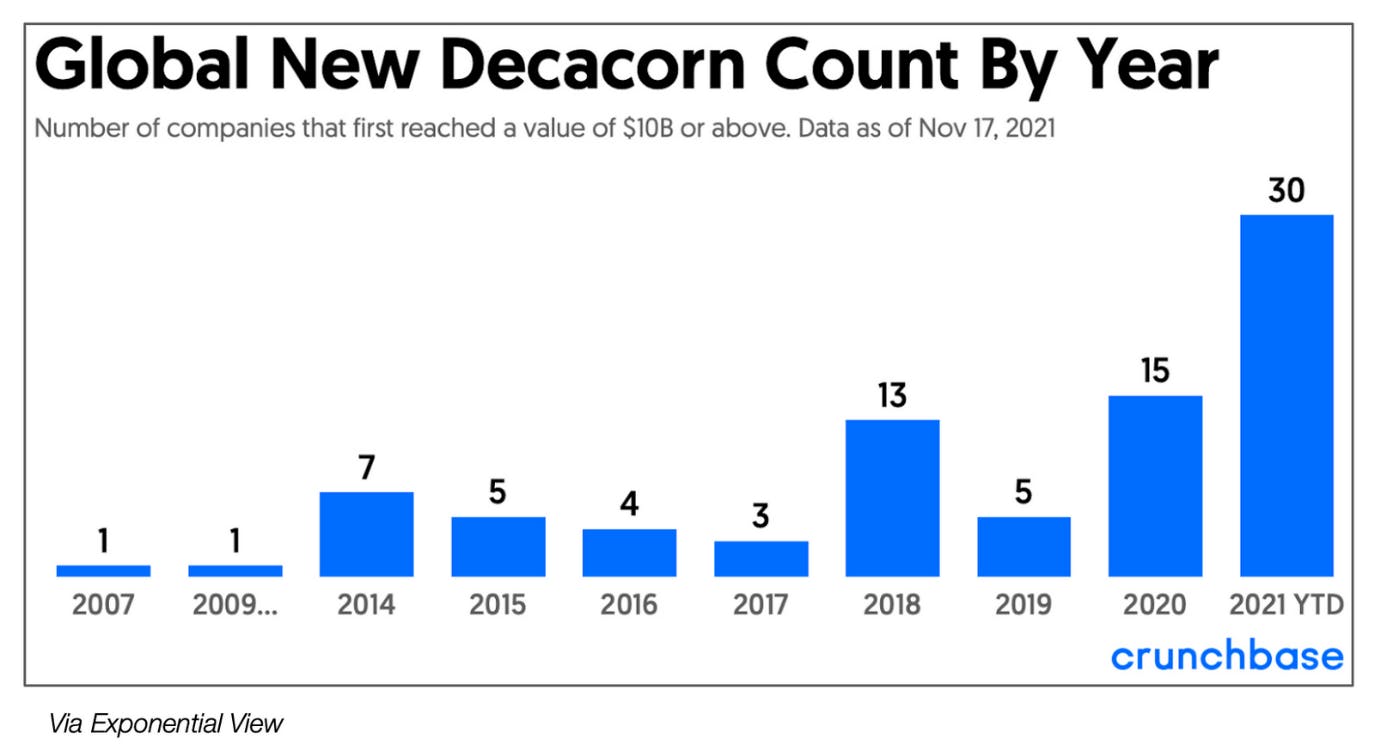

The Software and IT space has been running hot for some time. However, this year especially we have seen an incredible pace of development. The Pandemic has acted as a catalyst for the space especially for digitization efforts. For example, in Machine Learning we have seen interesting progress especially in spaces such as Language Processing. Although the underlying technologies and adoption thereof have improved significantly, even more prominently we have seen expectations and therefore valuations and funding amounts go even further.

Source: https://startup-map.berlin/intro

As early stage technology investors we have seen a trend of rising valuations and increasingly price insensitive early stage investors for some time. This year took this trend further, by a lot. Without intending to judge the particular merit of any of these, in a world where NFT’s and Crypto Currencies fetch eye watering prices it is no surprise to us that assets with more tangible cashflows are able to be valued where they are.

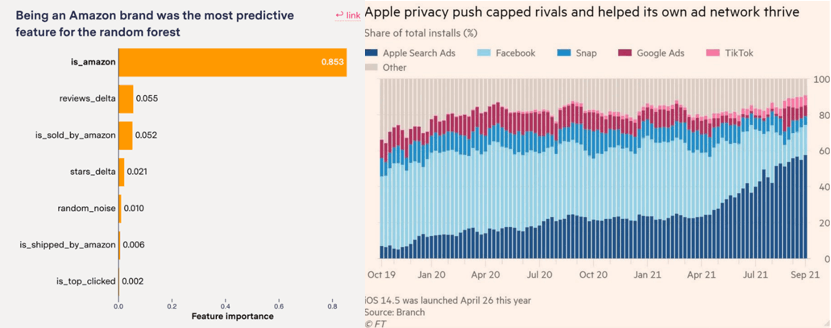

Especially since we support new industry entrants, we have been watching the development in the platform economy with interest. The biggest players have gone from providing open platforms where anyone could participate and do business to increasingly walled off “gardens” enclosed by their in-house search algorithms. Additionally, large players are currently enjoying disproportionately low financing costs in capital markets making competition incredibly hard. These changes have been going on for years but especially this year and last have accelerated. These, essentially momentum reinforcing features, fundamentally change the game theory for new entrants and other market participants which is why we believe it is important to continue to monitor these trends.

Source: https://themarkup.org/amazons-advantage/2021/10/14/how-we-analyzed-amazons-treatment-of-its-brands-in-search-results / Financial Times

Our Investment Activity

While these developments are taking place and making the early-stage venture space more competitive, we have also seen benefits for our portfolio companies. Our Company labforward raised a financing round and remind.me was able to raise a growth round. Since we have been watching progress in Machine Learning closely, we were also delighted to have future demand and up.lftd join our portfolio family. future demand and up.lftd both implement AI technology in a critical way to make their products work, while another yet unnamed company we've invested in is building an essential part of the infrastructure for anyone building an AI Product.

Since Christmas is fast approaching and the Christmas spirit is gradually enveloping all around us, we always look for fun Christmas activities. Our recommendation is to, for those who do not yet know it, try out this all-time classic: https://www.elfyourself.com/

At last, we would like to thank all those that make our industry and ecosystem possible, especially a round of applause for the founders and teams in our portfolio family!

Photo by Samira Rahi on Unsplash