Tips & Tools to help you prepare your VC round!

What we expect, what you will need, and some helpful templates

Hi, I’m Tobias Schimmelpfennig, Investment Manager at IBB Bet. — a VC firm investing in Berlin-based startups. From time to time I will update this article and add more tools. I am thus looking forward to your feedback! Let me know what you are missing.

You should read this article if you…

- are currently preparing your financing round and want to get an overview of a VC’s investment process,

- wonder which documents you have to prepare along a DD process,

- just want to snatch some helpful templates.

Then, this 5 min. read is the right choice for you!

Tl;dr: You can download the templates at the end of this post. 😉

Founders we talk to regularly report that they are often confronted with intransparent investment processes when speaking with VCs. Or they are first time founders and have not gained any fundraising experiences yet. This article shall support you to get a first feeling for the (our) VC investment process as well as to give you an overview which information and documents are required along the DD phases. And, of course, this article provides some tried and tested* tools and templates.

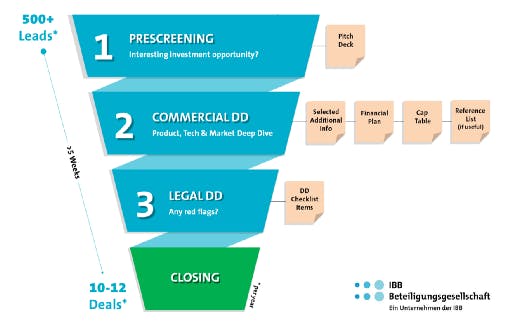

Our Investment Process at a glance

Simplified and in brief, we at IBB Bet. evaluate investment opportunities in three main stages**:

STEP 1: Prescreening

Founders usually contact us directly (e.g. here) or get intros by acquainted founders, co-investors or other partners. In either way, after having taken a first look at the pitch deck (and, if necessary, an initial call) we normally give you a first feedback within a few days and — in case that we are interested — invite you to a pitch presentation in front of our investment team.

You are wondering, which questions have to be addressed in a pitch deck? There are already lots of helpful blog articles on that (e.g. by Paua Ventures, PointNine or TheStartup), however, we have prepared a checklist with the main questions we want to touch base on (you can find it in the download section):

STEP 2 — Commercial Due Diligence (broad definition of deal structure in parallel)

Following a successful first assessment, we call for more in-depth information, e.g.

- more details on selected topics we consider as mission critical (e.g. Product, Market, Competition, Tech, and/or IP situation)

- a cap table that illustrates your shareholder structure and investment history (if applicable; we have added an excel tool for cap tables below),

- selected references to customers and partners (if necessary and value-creating) providing us with deeper insights into your business relationships, and

- a financial model, that transfers the business logic into figures (without the expectation that all assumptions in the model calculation will materialise, of course).

There are a bunch of great blog articles on how to prepare a financial model (e.g. by Christoph Janz or Senovo for SaaS companies). In order to develop a better feeling of our expectations we have prepared a brief summary below (you can find it in the download section as well):

After having considered all information and cleared up all open questions provided (in follow-up meetings, [reference] calls and by own research) and being convinced of an investment you will be invited to give a presentation in our Investment Committee Meeting. Here, our Managing Directors and two members of our investment team unanimously decide whether and under which conditions we are willing to participate in your financing round. Subsequently, we are also ready to negotiate and then sign a Term Sheet and take the next steps**.

Step 3 — Confirmatory Due Diligence (contract drafting and negotiations in parallel)

Once co-investors have been found and all parties settled on the fundamental conditions we are finally turning into the home stretch! In the course of our confirmatory DD we provide you with a checklist that contains all items that have to be examined prior to the closing. Although this list is being adapted depending on the target’s industry, business model and individual situation you can find our standard checklist at the end of this post. To help you prepare for this DD stage we have added some templates as well!

We usually have agreed on all final terms and drew up the contracts in parallel (in early-stage rounds we also offer to provide first drafts of the legal documentation in order to save costs) and are eventually ready for the signing at the notary!

Please note!

Of course this article is just broadly outlining the investment process and thus does not claim to be comprehensive. Although each company, situation, and investor‘s process is unique I hope to have given you a broad overview.

If you have any questions, ideas or suggestions or you want to get to know more about us, feel free to hit me up via mail (tobias.schimmelpfennig@ibb-bet.de) or LinkedIn.

If you want to learn more about our investment philosophy at IBB Bet. make sure you read the recent blog post of my colleague Laura Möller

Download Links

- Pitch Deck Cheat Sheet

- Financial Model Cheat Sheet

- Cap Table Tool, with special thanks to our former colleague Holger who once has developed our sophisticated internal tool which has been the basis for this!

- Our “standard” DD Checklist

* We certainly cannot guarantee the legal certainty of the provided documents, however, they have proven their worth in numerous financing rounds!

** Each company, situation, and industry has its own rules. Thus, an investment process in reality will certainly differ from that. Just take this as a first orientation.

*** We never make deals on a stand-alone basis (We can either act as lead investor or as co-investor though).

Picture Source: by Neil Thomas on unsplash